Bitcoin's New Bull Market Canceled, At Least For Now

With no signs of an increase in demand for the network, the resumption in the price of Bitcoin is still far from happening, pointing to a moment of accumulation.

Bitcoin’s bullish and bearish cycles are often marked by “foresight” signals and certain indicators provided by the network’s transparency.

Blockchain data analysis ensures real-time insight, with accuracy unmatched by any other asset. Right now, however, the situation seen on the net seems to indicate a less optimistic sentiment, as shown in the charts below.

The beginning of new bull markets is marked by the return of demand and network utilization, improvement in sentiment and return of speculation.

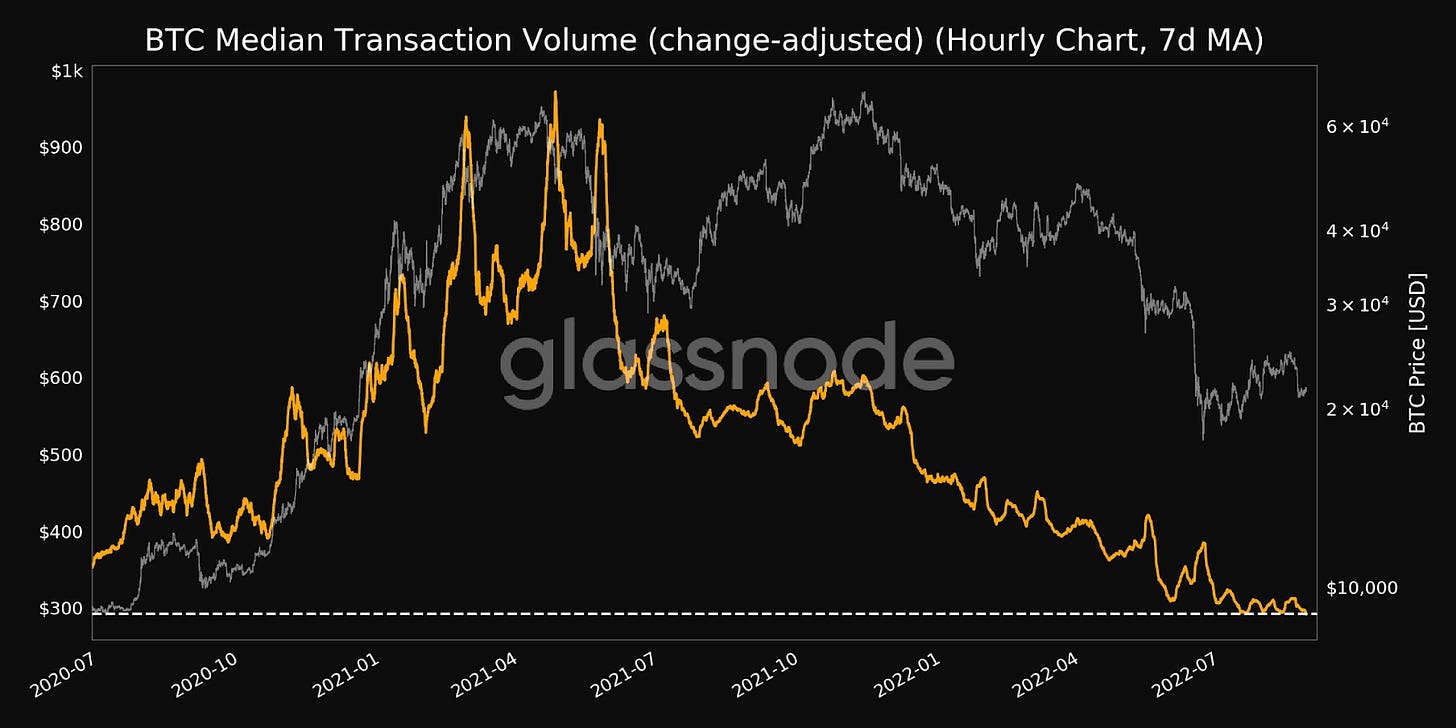

Seen in the chart above we have the median of the volume traded on-chain, reaching the lowest value in 2 years even with the rally of the last 2 months.

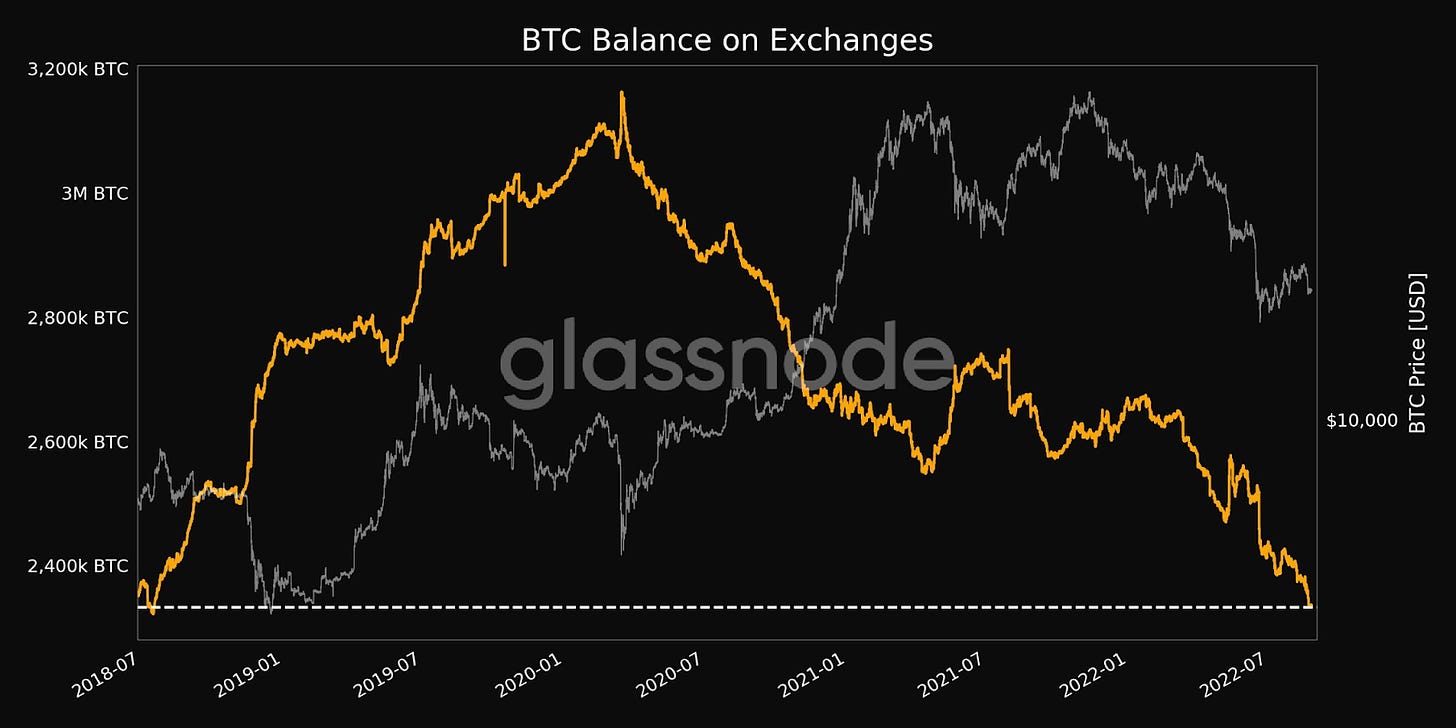

The same can be seen through the number of deposits on exchanges, also reaching the lowest value in 2 years.

Demand for trading and speculation is commonly associated with high trading volumes on exchanges, particularly those with many retail customers.

This also caused exchange reserves to be pushed to their 4-year low.

Low retail activity + stacking + low trust in custodians + growth in institutional reserves. This is causing the downtrend in these reserves.

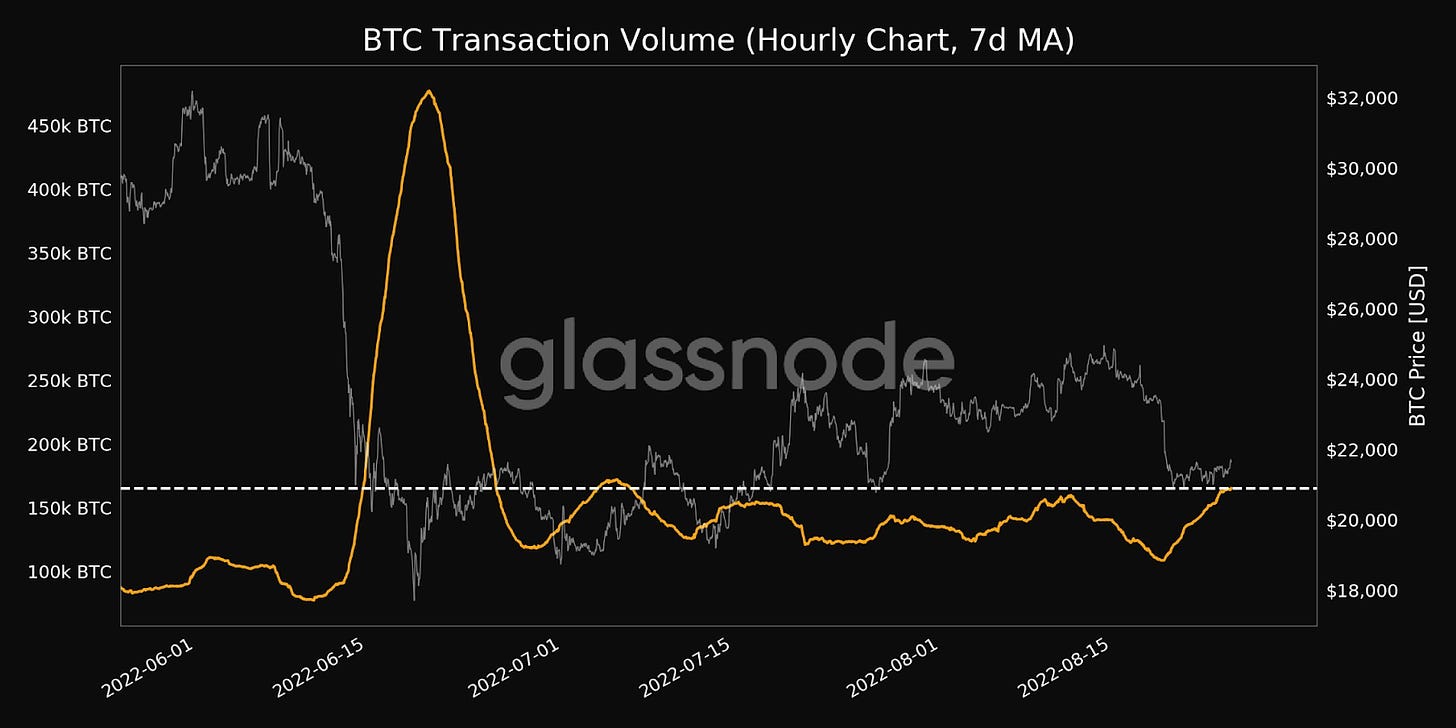

Now, when we approximate the on-chain volume, that is, transactions made in the base layer, we see that the last peak of activity was during the June sell off.

An evident period of capitulation and “panic selling” that raised the level of movement, It has since remained sideways even as prices have climbed since this period.

This shows that despite the rise in prices, spot demand remained low, which could possibly have made derivative instruments drive the price rise.

This type of situation can show that there is still no high demand for the network at this moment and therefore a euphoric price escalation is highly unlikely.

However, this does not mean that we will immediately seek new lows.

If the price sustains here, it is possible to see a good period of lateralization that can be broken if there is a return of activity and demand for trading and speculation.

For now, most participants remain inactive, including institutional ones.

Good time for long-term accumulators, but for short-term traders, caution is needed.

This article was initially posted on this BlockTrends link. Study developed by Cauê Oliveira, graphics by Glassnode.