The Truth About Bitcoin “Supply Shock” on Exchanges

Despite the view that reductions in exchange reserves are a predominant factor in bitcoin price action in the short term, data reveals that this may be a misconception.

If you enjoy content about bitcoin data analysis and on-chain fundamentals, be sure to follow @caueconomy. This content is for educational and theoretical purposes only; the views presented may change with new market dynamics.

1. The Bitcoin “Supply Shock”

Bitcoin exchange reserves are an important indicator of short-term liquidity, reflecting the amount of coins available for immediate trading. This widely used metric excludes transactions carried out in over-the-counter (OTC) markets and ETFs, meaning it represents only a fraction of total liquidity.

The recent ongoing decline in exchange reserves is often interpreted as a long-term holding movement, in which investors prefer to store their coins in private wallets or cold storage. This interpretation, while valid, is insufficient to explain the complexity of the market.

It is important to note that a significant portion of this reduction in exchange reserves does not necessarily reflect a decrease in market liquidity. Data from Glassnode indicates that since the approval of Bitcoin Spot ETFs in January 2024, a large portion of the coins withdrawn from exchanges have been transferred to institutional custodian wallets, such as those operated by Coinbase.

With the growing demand for ETF products, there has been a significant migration of coins to institutional custodians, keeping these coins liquid and available in the market.

When considering the combined balance of exchanges and ETF wallets, the level of available BTC has fluctuated around 3 million BTC, close to the total balance observed on exchanges in January 2024. Thus, the apparent reduction in exchange reserves should be interpreted as a change in market structure, rather than as a supply shock caused by withdrawals by individual investors.

The nominal value of these reserves, expressed in dollars, adds a crucial perspective to the debate. Multiplying the amount of BTC stored on exchanges by the price of the asset, we obtain the total dollar value of these reserves. This calculation allows us to identify whether the reduction in the amount of BTC is offset by an appreciation in the price, highlighting the interplay between supply and demand.

It is important to note that the price of Bitcoin reflects a complex interplay of these variables, with demand playing a central role. This study derived the price by dividing the total dollar value of reserves by the amount of available BTC, allowing us to analyze the dynamics between these variables over time.

2. Analytical Approach

The analysis utilized three primary metrics: price-supply elasticity, capital required to sustain prices, and normalized reserve. These metrics provide a quantitative foundation for evaluating the relationship between changes in BTC reserves and price dynamics.

Price-Supply Elasticity: Price-supply elasticity measures Bitcoin's price sensitivity to variations in the available supply on exchanges. It is calculated using the formula:

Where:

%ΔP: Percentage change in Bitcoin's price.

%ΔQ: Percentage change in BTC quantity available on exchanges.

This metric reveals whether small changes in supply significantly impact prices. A low elasticity suggests that Bitcoin's price is influenced more by factors beyond the immediate supply.

Capital Required to Sustain Prices: This component estimates the capital flow needed to absorb the reduction in reserves and maintain the asset's appreciation, calculated as:

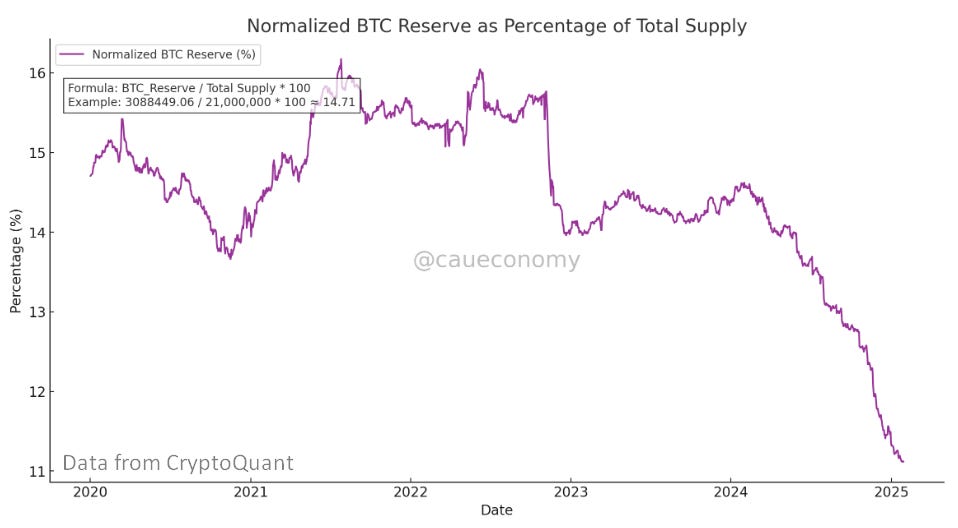

Normalized Reserve: Normalized reserve evaluates the relative concentration of BTC on exchanges compared to the total supply of 21 million coins. It is expressed as:

Coefficient of Determination (R^2): To assess the relationship between BTC reserve changes (%ΔQ) and price changes (%ΔP), a linear regression was applied:

Where:

y: Percentage change in Bitcoin price (%ΔP).

x: Percentage change in BTC reserves (%ΔQ).

R^2: Coefficient of determination.

3. Results and Visualizations

The analysis, based on data from CryptoQuant and Glassnode revealed significant trends challenging the "supply shock" narrative:

Decline in Exchange Balances: Between 2020 and 2025, BTC reserves dropped from 3,088,164 BTC to 2,334,654 BTC, representing a 24.40% reduction. However, this decline is partially due to the redistribution of coins to other forms of custody, such as ETFs.

Nominal Value of Reserves: The nominal USD value of reserves increased from approximately $23.5 billion to $244.85 billion, reflecting the substantial appreciation in Bitcoin's price over the period, which offset the reduction in BTC quantity.

Price-Supply Elasticity: The average daily price-supply elasticity was 4.61, suggesting that daily variations in BTC supply have a limited impact on price. This reinforces the idea that Bitcoin's price is more influenced by external factors like demand and capital inflows than by short-term supply changes.

Capital Absorbed: On average, $1.8 billion in capital was absorbed daily to sustain Bitcoin’s appreciation during the period analyzed. During high volatility, this capital inflow likely exceeded $2.5 billion daily, highlighting the importance of capital inflows in the Bitcoin market.

Normalized Reserve: BTC reserves on exchanges, relative to the total supply of 21 million coins, fell from 16.17% in 2020 to 11.11% in 2025. This suggests a trend of long-term retention, with investors preferring to store their coins off exchanges, but also the absorption from others institutions.

Impact of ETFs: A significant portion of the decline in exchange balances stems from the migration of coins to ETF wallets, particularly after the approval of Bitcoin Spot ETFs in January 2024. ETFs managed by custodians like Coinbase absorbed much of the coins withdrawn from exchanges.

Consequently, the combined balance of BTC on exchanges and ETFs oscillated around 3 million BTC since 2024, indicating that these coins remain liquid and accessible to the market according to CryptoVizArt, in a recent study published by Glassnode.

This change represents a structural redistribution in the market. Coins previously held on exchanges are now under the custody of institutional entities, challenging the interpretation that reduced exchange balances signify a genuine supply shortage. These coins continue to play an active role in the ecosystem.

Coefficient of Determination (R^2=0.00091): This very low value indicates that less than 0.1% of Bitcoin's price variation is explained by changes in exchange reserves. This suggests that other factors, such as demand from institutional investors, macroeconomic conditions, and adoption trends, play a far more significant role in price determination.

4. Interpretation and Reflections

The findings suggest that the "supply shock" narrative is limited. A reduction in BTC reserves alone does not justify Bitcoin's appreciation. The low price-supply elasticity indicates that Bitcoin's price depends more on demand-related factors than on immediate exchange supply.

The primary driver of price appears to be a steady inflow of capital into the market. Events such as increased institutional adoption, regulatory changes, and growing recognition of Bitcoin as a store of value play more significant roles. Without these capital inflows, the relative scarcity of BTC would have a limited impact.

Furthermore, the analysis highlights that retaining BTC in private wallets or cold storage signifies long-term confidence in the asset. However, this does not necessarily result in immediate price increases but instead establishes a solid foundation for future appreciation, provided demand continues to grow.

5. Conclusions

While the "supply shock" narrative has merits, the analyzed data suggest it is not the primary factor behind Bitcoin's appreciation. Instead, Bitcoin's price is supported by constant capital inflows and the willingness of investors to absorb available coins, even at higher prices. This dynamic emphasizes the importance of events that increase demand and Bitcoin's perceived value.

The study demonstrates that Bitcoin, as an asset, is governed by traditional market forces such as supply, demand, and capital flow. Understanding these dynamics is essential for making informed decisions, especially in an ever-evolving market. Thus, the "supply shock" should be viewed as part of a broader context where demand plays a central role.

6. Potential Future Impact of Exchange Reserves on Market Dynamics

Although previous analysis indicates that exchange reserves are not a primary driver of Bitcoin price dynamics, their importance may increase in the future as Bitcoin's supply becomes more distributed across various institutions, including banks and ETFs. This dispersion could create a scenario where true scarcity intensifies.

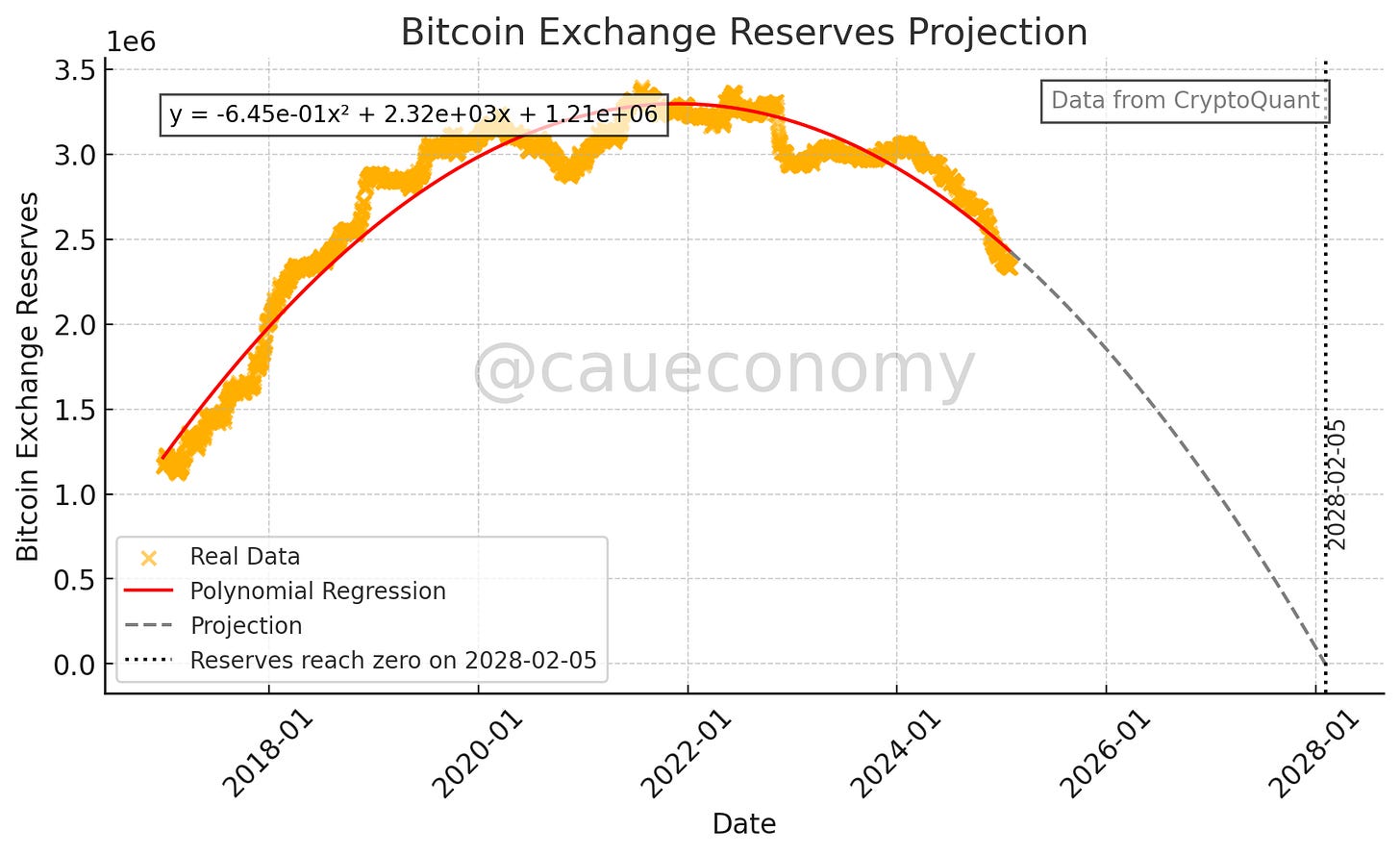

Projection of Exchange Reserves Reaching Zero

A polynomial regression model predicts that Bitcoin reserves on exchanges could reach zero by 2028-02-05, based on the following formula:

Where:

y: Bitcoin reserves on exchanges (in BTC).

x: Time (in days since the start of the analysis).

The projection highlights an accelerating pace of Bitcoin withdrawals from exchanges. As reserves approach zero, market liquidity could become severely constrained, intensifying scarcity and creating greater price sensitivity to shifts in demand.

The Role of Synthetic Bitcoin Products

In this potential future, institutions like banks and ETFs might issue synthetic Bitcoin products or IOUs (promissory notes representing Bitcoin) instead of direct ownership of Bitcoin. These synthetic representations could increase the perceived liquidity of Bitcoin in the market while masking its true scarcity. As a result:

The supply of "real Bitcoin" available for immediate trading could diminish.

Exchange reserves would serve as a critical and transparent indicator of the actual liquidity in the market.

Implications for Market Dynamics

If exchange reserves continue their downward trajectory and synthetic products dominate the market, true supply constraints may emerge. This could:

Amplify price volatility due to heightened sensitivity to even small demand shocks.

Elevate the importance of transparent metrics, such as exchange reserves, in understanding Bitcoin's real liquidity.

This scenario underscores the potential for exchange reserves to play a pivotal role in shaping market dynamics, especially as institutional adoption grows and Bitcoin's distribution becomes more complex.

Therefore, although drops in exchange reserves are not currently a predominant factor in the price of bitcoin, they may play a larger role in the future.

Massive work. Thanks for sharing mate!

Great