Trump Trade War

Trump launched a new wave of tariffs that impacts US$ 1.3 trillion in global trade and markets bled over the weekend.

If you enjoy content about bitcoin data analysis and on-chain fundamentals, be sure to follow @caueconomy. This content is for educational and theoretical purposes only; the views presented may change with new market dynamics.

Trump has launched a new wave of tariffs that will impact $1.3 trillion in global trade. The consequences are already being felt in the economy.

What does this mean? How will it affect the dollar, inflation and markets? Let's take a look.

As of February 4, 2025, new tariffs on imports will come into effect:

25% on products from Canada and Mexico

10% on imports from China

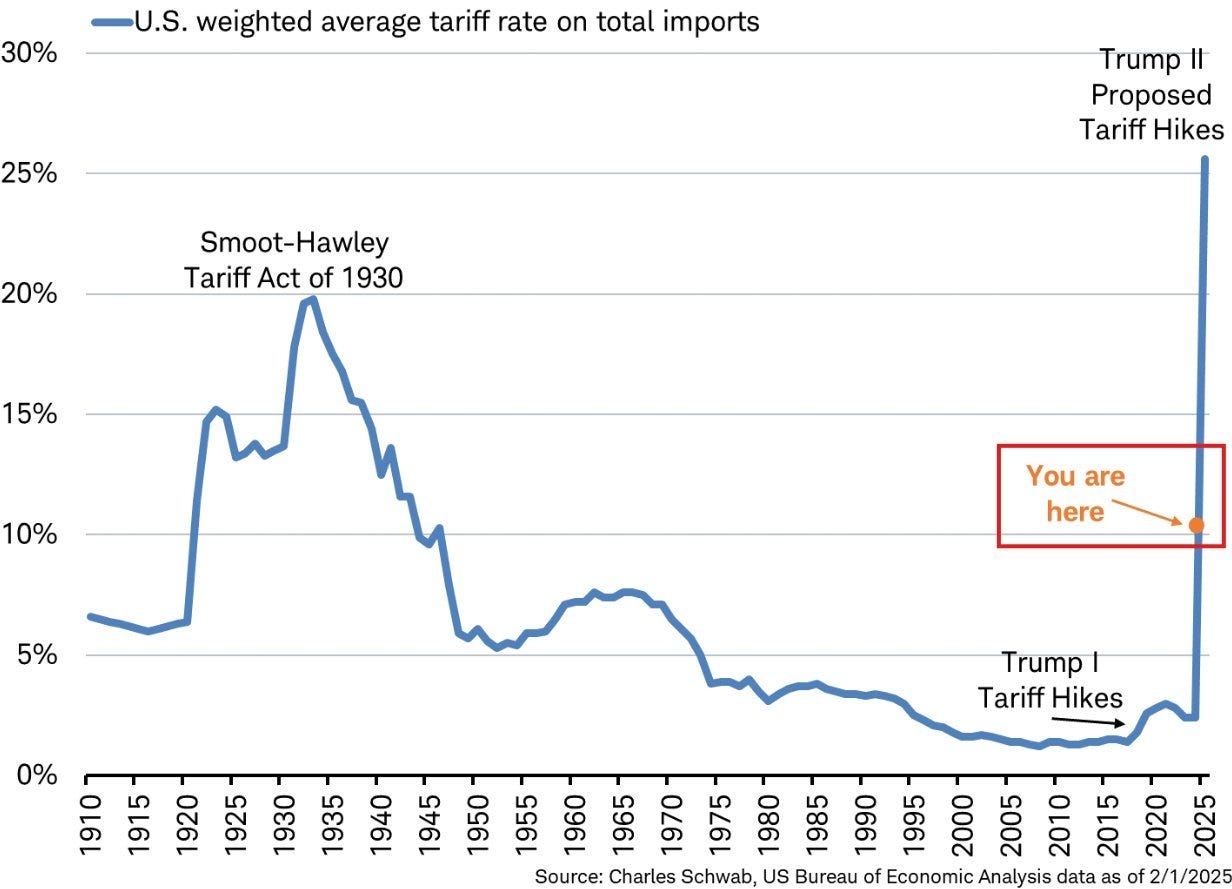

Some tariffs on China are left over from the last trade war. In total, 43% of all American imports will be subject to higher taxes.

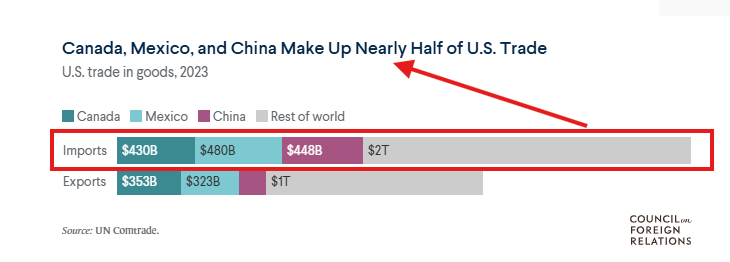

The US imported $910 billion from Canada and Mexico in 2023. Many of these products will now incur an additional 25% tariff.

Canada exports $97 billion in oil and $80 billion in parts and vehicles to the US. Mexico supplies more than 60% of the fresh produce consumed by Americans. China is responsible for $55 billion in electronics that enter the US annually.

With the increase in tariffs, these sectors will see their prices rise, directly affecting inflation and production costs in the US.

Tariffs act as an indirect tax, raising prices for consumers and businesses. The average cost of vehicles could rise by up to US$3,000 per unit, while food imported from Mexico will have a strong impact on the price chain.

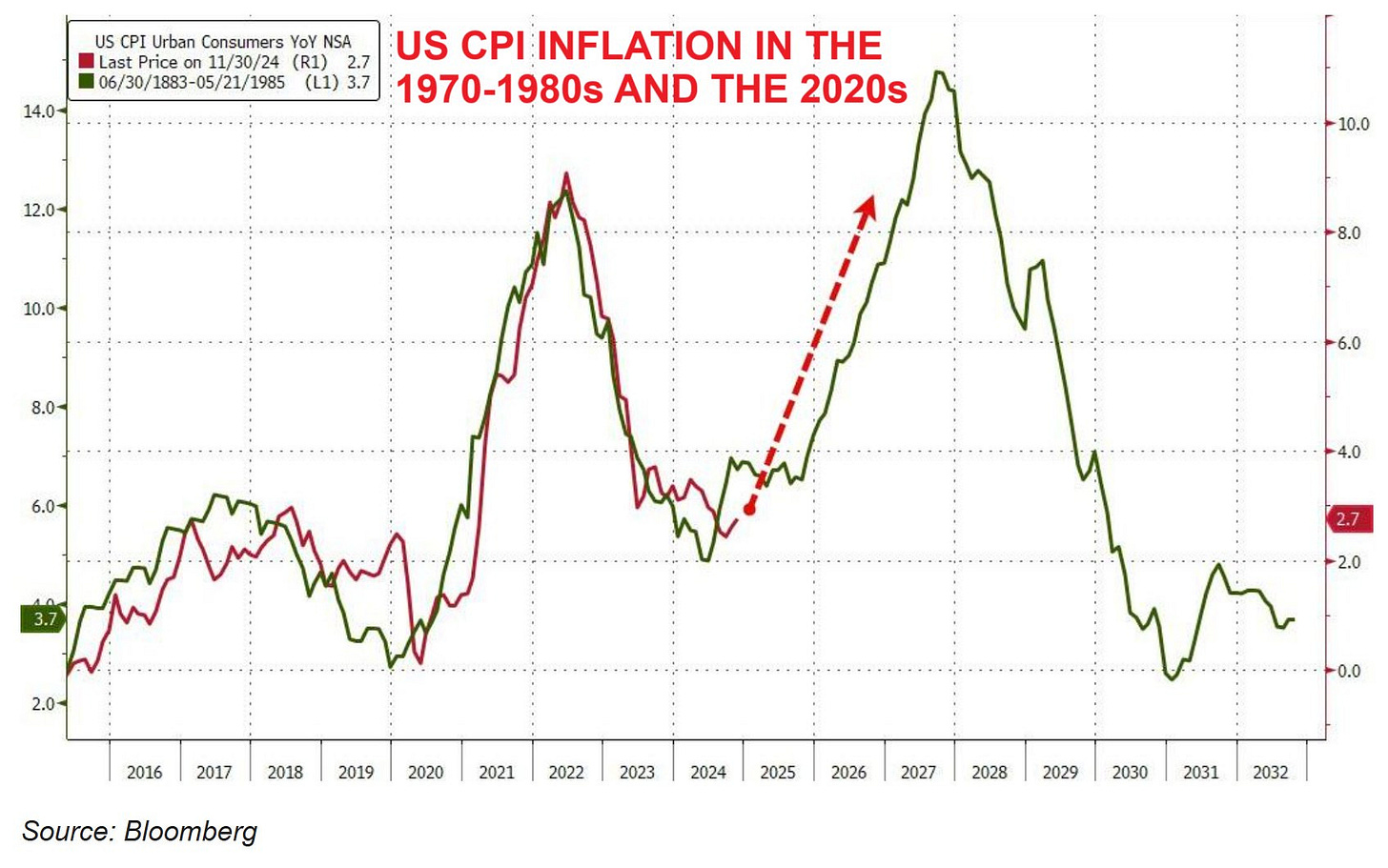

This inflationary pressure puts the Federal Reserve in a challenging position, as inflation in the US had already been slowing after a long period of high interest rates.

If tariffs drive up inflation, the Fed may be forced to keep interest rates high for longer to contain it. This would lead to less liquidity in the market, more expensive credit for companies and consumers, and a strengthening of the dollar, making US exports less competitive.

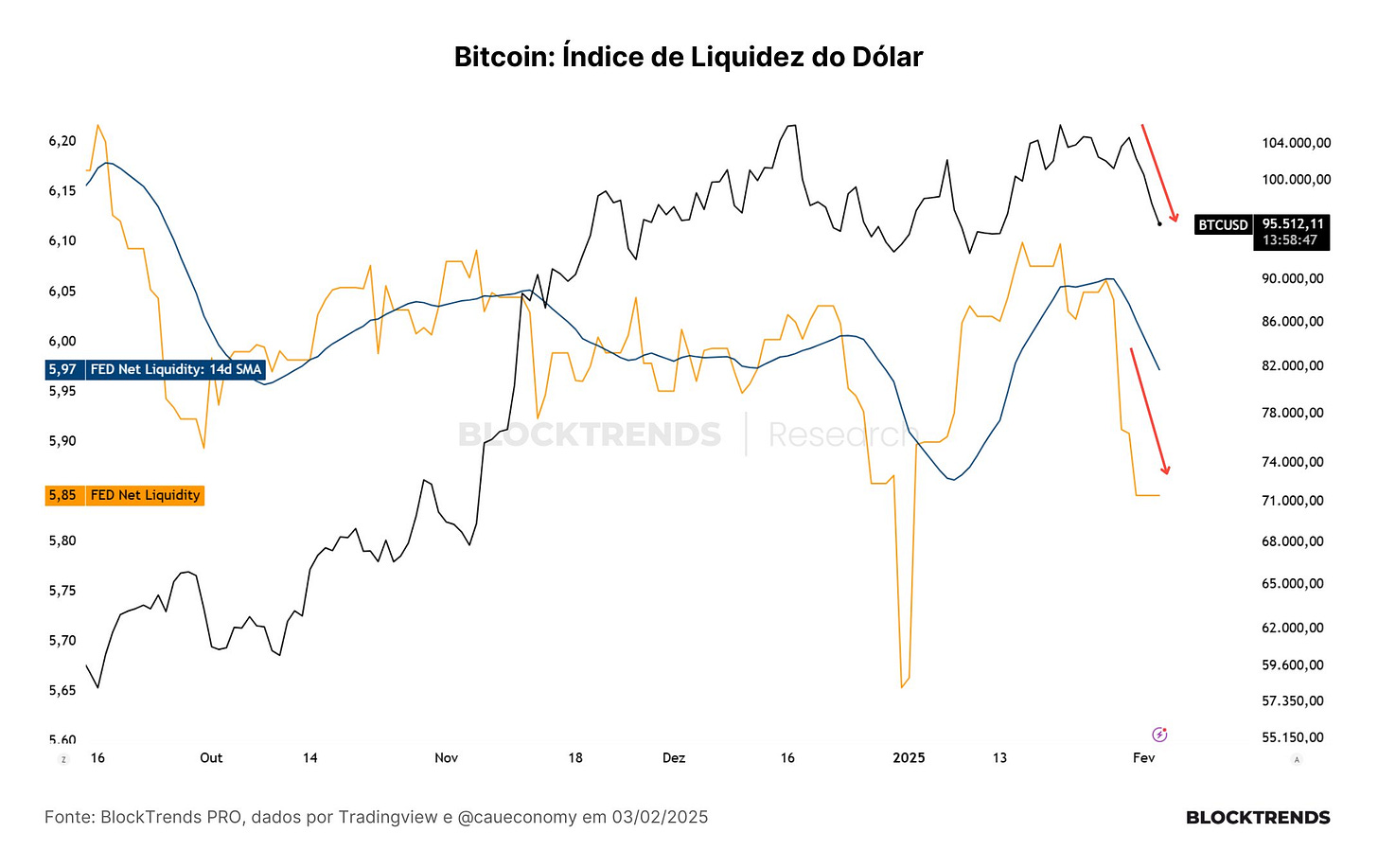

If, on the other hand, the economy slows significantly due to the drop in consumption and trade, the government could adopt fiscal and monetary stimulus to avoid a recession, increasing liquidity in the system. This liquidity is already very limited.

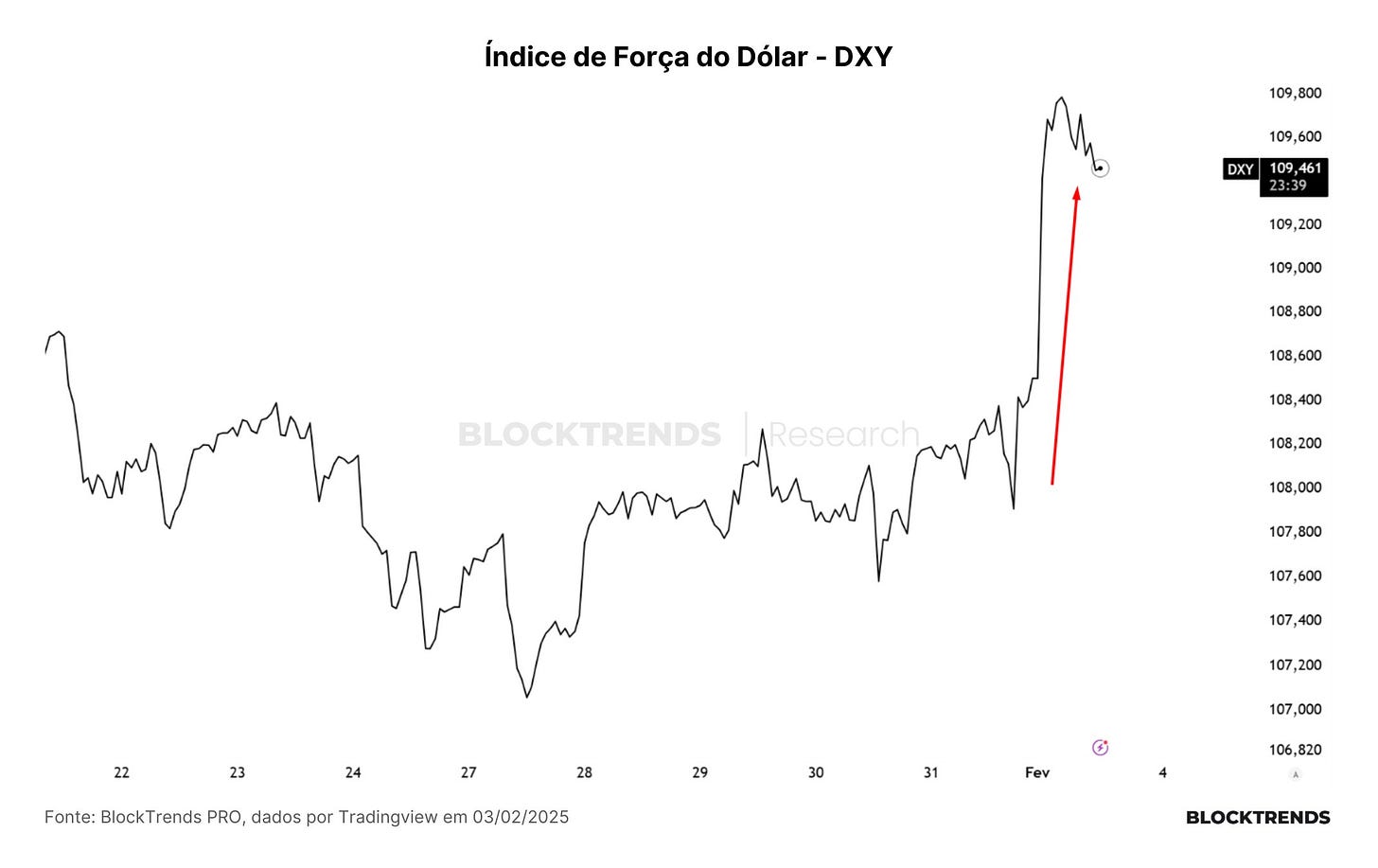

The announcement of the tariffs has already caused a 3% drop in US stock indexes. The dollar has strengthened as fewer dollars are leaving the US for imports, and global demand for US bonds remains high.

The appreciation of the dollar has also resulted in a drop in the price of gold, which had been following the rise of the US currency recently. This movement reflects the search for short-term liquidity in the face of trade uncertainty.

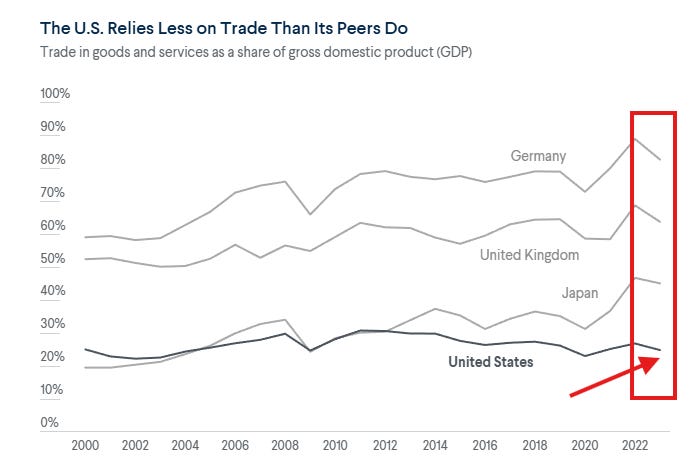

International trade represents less than 30% of US GDP, but in Canada and Mexico, the US is the main export destination, accounting for 80% of these countries' foreign trade.

China has already indicated that it will retaliate, but has not yet detailed the measures. Restrictions on the semiconductor sector and new tariffs on US products can be expected, further impacting the US technology sector.

The Strategy Behind Tariffs

In the 1980s, the US negotiated the Plaza Accord, which resulted in the devaluation of the dollar to rebalance global trade.

Now, tariffs could be used as a pressure tool to force other countries to reduce their dollar reserves and extend their US debt, weakening the currency without direct action by the Fed.

In the short term, inflation could rise, and the Fed could be forced to keep interest rates high. This would mean less liquidity and an even stronger dollar.

If the economic slowdown intensifies, the government may have to expand liquidity to avoid a recession. This could reverse some of the dollar’s appreciation and generate new market stimulus.

The trade war is back on track and could have structural consequences for global trade. The US is trying to pressure its trading partners, but it may be preparing a larger plan to reduce the dollar’s strength in the long term.

Inflation, interest rates and global markets now depend on the Fed’s response and China’s retaliation.

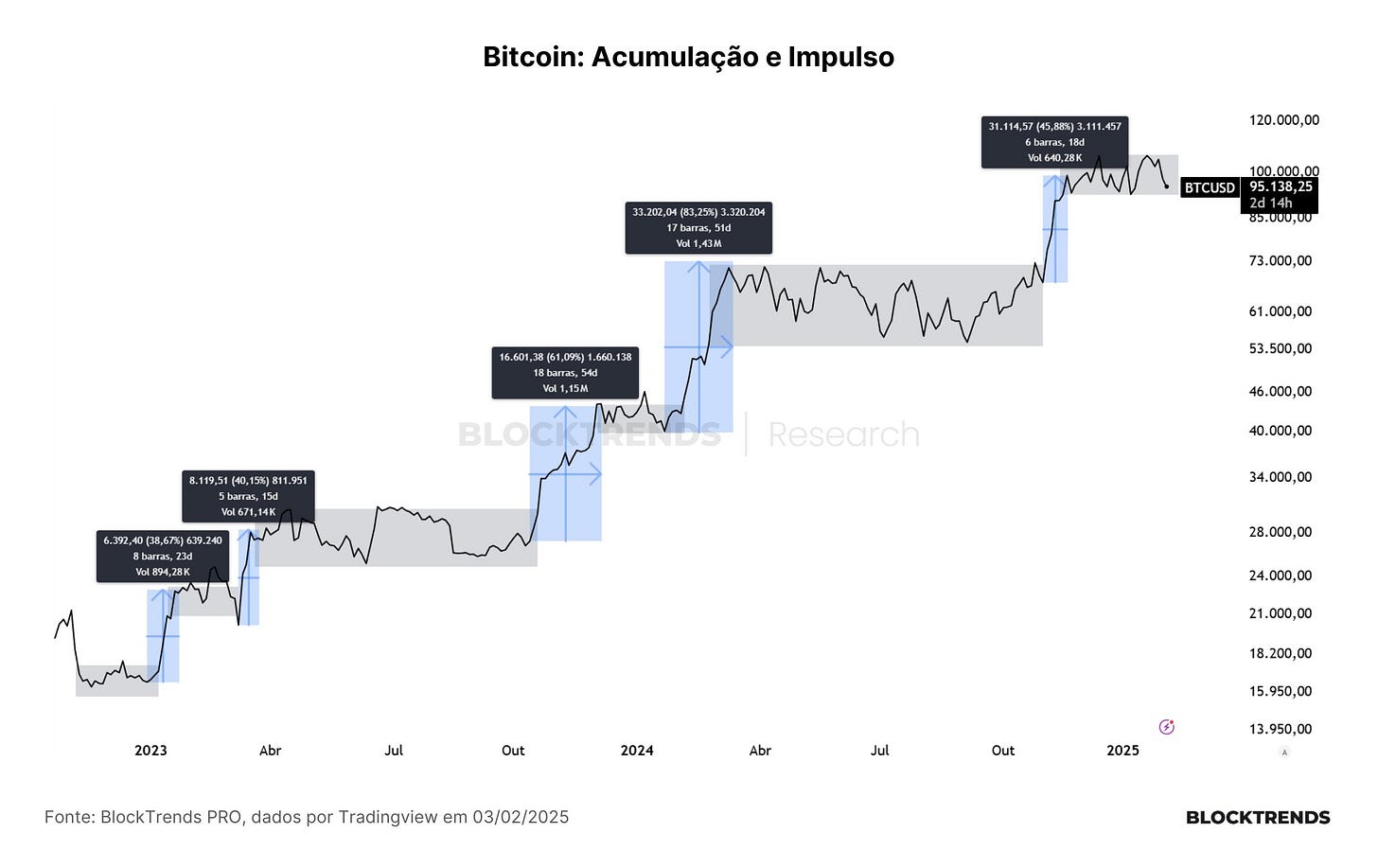

But what is important for everyone to understand is the need to have LOW TIME PREFERENCE at this time. Look at the accumulation and momentum cycles.

Right now, we are in another period of accumulation and many who are too "hasty" will not be able to position themselves well for the momentum.

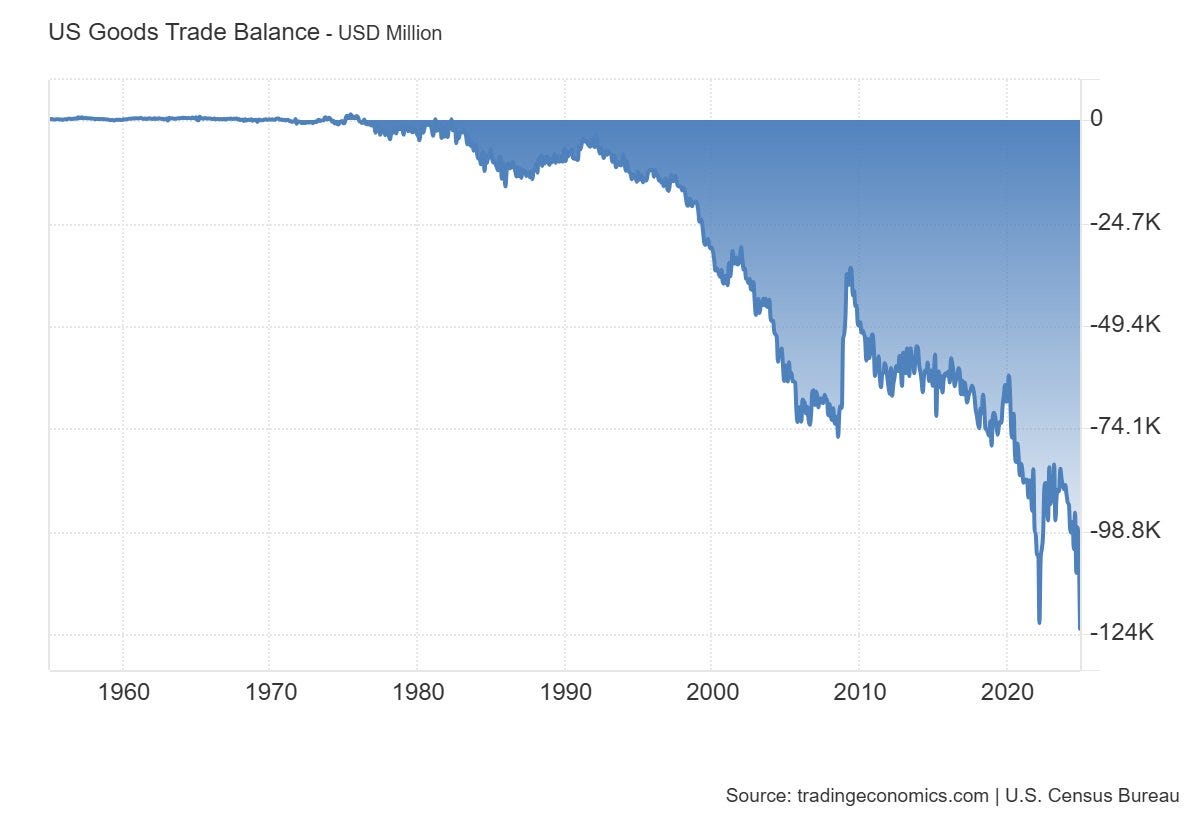

Remember that, in the long run, the US trade balance continues to generate larger deficits each year.

This has been happening since the 1970s, as this is how the US exports its inflation to the planet. Thus, they will continue to issue debt to cover their fiscal and trade deficits.

In the long run, bitcoin remains more than well positioned to capture the excess liquidity that will eventually arise with this new trade war.

But not all individuals will be well positioned in bitcoin.

Focus on the signal, not the noise. 💡

#HODL